Support & Guidance for Businesses during COVID-19

06.05.2021

Community Vaccination Leaders Programme

The vaccination programme – the biggest in NHS history – is progressing very well with over 34m people having received their first dose and over 14m both doses meaning a total of over 48m vaccinations have been given so far.

Getting vaccinated against COVID-19 is the most effective way of protecting people against this deadly and devastating virus. Our ambitions are set high and we want all communities to have a maximum uptake in people getting their vaccine. COVID-19 has adversely impacted on our marginalised and vulnerable communities. Ensuring uptake of vaccinations amongst all our richly diverse community is a way of bucking this trend.

We can’t do this alone.

We recognise the power you have to work to improve health outcomes.

Sandwell Public Health are offering an in-depth COVID-19 vaccination leader training and support programme. The programme will include:

- Exclusive online briefings with our Director of Public Health and other public health specialists on the latest local data

- How to tackle vaccine misinformation

- Tips and techniques on how to be a powerful influencer

- Access to a promotional toolkit and resources

- Priority access to bespoke creative and marketing services including: printing, graphic design, social media content and much more.

The training will be delivered virtually via Microsoft teams and will last 2 hours in total. The dates and times of sessions are below. You only need to attend one of these sessions.

Wednesday 26 May, 1.00 – 3.00pm

Wednesday 2 June, 1.00pm – 3.00pm

Places on this programme are limited so book soon to avoid disappointment.

To apply please email: PHCovid19Community@sandwell.gov.uk

Please state in the email:

- Name

- Organisation you are affiliated with

- Why you want to be a COVID-19 vaccination leader

- Which session you would like to book onto

26.03.2021

Restart Grants applications will be available to apply for after the 1st April 2021 and there will be 2 grants available

Strand One – To support non-essential retail business premises

– Businesses occupying hereditaments appearing on the local rating list with a rateable value of exactly £15,000 or under on 1 April 2021 will receive a payment of £2,667.

– Businesses occupying hereditaments appearing on the local rating list with a rateable value over £15,000 and less than £51,000 on 1 April 2021 will receive a payment of £4,000.

– Businesses occupying hereditaments appearing on the local rating list with a rateable value of exactly £51,000 or over on 1 April 2021 will receive a payment of £6,000.

Strand Two – To support hospitality, accommodation, leisure, personal care and gym business premises

– Businesses occupying hereditaments appearing on the local rating list with a rateable value of exactly £15,000 or under on 1 April 2021 will receive a payment of £8,000.

– Businesses occupying hereditaments appearing on the local rating list with a rateable value over £15,000 and less than £51,000 on 1 April 2021 will receive a payment of £12,000.

– Businesses occupying hereditaments appearing on the local rating list with a rateable value of exactly £51,000 or over on 1 April 2021 will receive a payment of £18,000.

All grants can be applied for through http://www.grantapproval.co.uk

More information can be found at https://www.sandwell.gov.uk/info/200176/business/4476/coronavirus_%E2%80%93_support_for_businesses

25.02.2021

Gov.uk have released a more indepth guidance on the shops that can open from 12.04.2021. This can be found via the link below:

Reopening of Businesses in England

22.02.2021

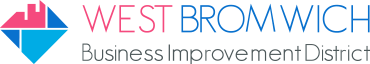

Following Boris Johnson’s announcement of his recovery roadmap, below is the chart that outlines when certain businesses can open!

04.02.2021 – Sandwell Council Grants Flowchart

15.01.2021 – Business Grants Available

Business Grants are n0w live for financial support through this lockdown.

You can access all grants available to your business through www.grantapproval.co.uk

If you are a business within our BID area and you need support and guidance, please do not hesitate to contact us on 07719546973 or admin@westbromwichtown.co.uk

05.01.2021 – Lockdown 3

- Non-essential retail, such as clothing and homeware stores, vehicle showrooms (other than for rental), betting shops, tailors, tobacco and vape shops, electronic goods and mobile phone shops, and market stalls selling non-essential goods. These venues can continue to be able to operate click-and-collect (where goods are pre-ordered and collected off the premises) and delivery services

- Hospitality venues such as cafes, restaurants, pubs, bars and social clubs; with the exception of providing food for takeaway (before 10pm; and not including alcohol), click-and-collect, drive-through or delivery

- Accommodation such as hotels, hostels, guest houses and campsites. Except for specific circumstances, such as where these act as someone’s main residence, where they cannot return home, for homeless people, or where it is essential to stay there for work purposes

- Leisure and sports facilities such as leisure centres and gyms, swimming pools, tennis and basketball courts, golf courses, fitness and dance studios, climbing walls, archery, driving, and shooting ranges

- Entertainment venues such as theatres, concert halls, cinemas, museums and galleries, casinos, amusement arcades, bingo halls, bowling alleys, skating rinks, go-karting venues, soft play centres and areas, circuses, funfairs, zoos and other animal attractions, water parks, theme parks. Indoor attractions at botanical gardens, heritage homes and landmarks must also close, though outdoor grounds of these premises can stay open

- Personal care facilities such as hair, beauty, tanning and nail salons. Tattoo parlours, spas, massage parlours, body and skin piercing services must also close. It is also prohibited to provide these services in other peoples’ homes

- Community centres and halls must close except for a limited number of exempt activities as set out below Libraries can also remain open to provide access to IT and digital services – for example for people who do not have it at home – and for click-and-collect

- Places of worship, apart from for the purposes of independent prayer, and service broadcasting and funerals

The following businesses will be allowed to stay open, as long as they provide essential services or products:

- Essential retail such as food shops, supermarkets, pharmacies, garden centres, hardware stores, building merchants and off-licences.

- Petrol Stations, car repair and MOT services, bicycle shops, and taxi and vehicle hire businesses.

- Banks, building societies, post offices, loan providers and money transfer businesses

- Funeral directors

- Launderettes and dry cleaners

- Medical and dental services

- Vets and pet shops

- Agricultural supplies shops

- Storage and distribution facilities

- Car parks, public toilets and motorway service areas.

- Outdoor playgrounds

The majority of public services will continue and you will be able to leave home to visit them. These include:

- the NHS and medical services like GPs and dentists.

- Jobcentre Plus sites

- Courts and probation services

- Civil Registrations Offices

- Passport and Visa Services

- Services provided to victims

- Waste or Recycling Centre

17.11.2020

16.11.2020

APPLICATIONS ARE NOW LIVE FOR LOCAL RESTRICTIONS SUPPORT GRANTS

LOCAL RESTRICTIONS SUPPORT GRANTS

The Local Restrictions Support Grant (LRSG) supports businesses that have been required to close due to temporary COVID-19 local lockdown restrictions. This will be paid by the Sandwell Council for the 28-day lockdown period.

Payments will be as follows:

- Businesses occupying hereditaments appearing on the local rating list

with a rateable value of exactly £15,000 or under on the date of the

commencement of the widespread national restrictions will receive a

payment of £1,334 per 28-day qualifying restriction period. - Businesses occupying hereditaments appearing on the local rating list

with a rateable value over £15,000 and less than £51,000 on the date

of the commencement of the widespread national restrictions will

receive a payment of £2,000 per 28-day qualifying restriction period. - Businesses occupying hereditaments appearing on the local rating list

with a rateable value of exactly £51,000 or above on the

commencement date of the widespread national restrictions, will

receive £3,000 per 28-day qualifying restriction period.

Please keep an eye on this page for updates as to when this grant will be available.

- Stay at home, except for specific purposes.

- Avoid meeting people you do not live with, except for specific purposes.

- Close certain businesses and venues.

A full list of the new restrictions can be found here:

This also means that certain businesses must close, these include:

- Non-essential retail, such as clothing and homeware stores, vehicle showrooms (other than for rental), betting shops, tailors, tobacco and vape shops, electronic goods and mobile phone shops, and market stalls selling non-essential goods. These venues can continue to be able to operate click-and-collect (where goods are pre-ordered and collected off the premises) and delivery services

- Hospitality venues such as cafes, restaurants, pubs, bars and social clubs; with the exception of providing food and drink for takeaway (before 10pm; and not including alcohol), click-and-collect, drive-through or delivery

- Accommodation such as hotels, hostels, guest houses and campsites. Except for specific circumstances, such as where these act as someone’s main residence, where they cannot return home, for homeless people, or where it is essential to stay there for work purposes

- Leisure and sports facilities such as leisure centres and gyms, swimming pools, tennis and basketball courts, golf courses, fitness and dance studios, climbing walls, archery, driving, and shooting ranges

- Entertainment venues such as theatres, concert halls, cinemas, museums and galleries, casinos, amusement arcades, bingo halls, bowling alleys, skating rinks, go-karting venues, soft play centres and areas, circuses, funfairs, zoos and other animal attractions, water parks, theme parks. Indoor attractions at botanical gardens, heritage homes and landmarks must also close, though outdoor grounds of these premises can stay open

- Personal care facilities such as hair, beauty, tanning and nail salons. Tattoo parlours, spas, massage parlours, body and skin piercing services must also close. It is also prohibited to provide these services in other peoples’ homes

- Community centres and halls must close except for a limited number of exempt activities as set out below Libraries can also remain open to provide access to IT and digital services – for example for people who do not have it at home – and for click-and-collect

- Places of worship, apart from for the purposes of independent prayer, and service broadcasting and funerals

The following businesses will be allowed to stay open, as long as they provide essential services or products:

- Essential retail such as food shops, supermarkets, pharmacies, garden centres, hardware stores, building merchants and off-licences.

- Petrol Stations, car repair and MOT services, bicycle shops, and taxi and vehicle hire businesses.

- Banks, building societies, post offices, loan providers and money transfer businesses

- Funeral directors

- Launderettes and dry cleaners

- Medical and dental services

- Vets and pet shops

- Agricultural supplies shops

- Storage and distribution facilities

- Car parks, public toilets and motorway service areas.

- Outdoor playgrounds

The majority of public services will continue and you will be able to leave home to visit them. These include:

- the NHS and medical services like GPs and dentists.

- Jobcentre Plus sites

- Courts and probation services

- Civil Registrations Offices

- Passport and Visa Services

- Services provided to victims

- Waste or Recycling Centres

Face Coverings

- Customers in private hire vehicles and taxis must wear face coverings (from 23 September).

- Customers in hospitality venues must wear face coverings, except when seated at a table to eat or drink. Staff in hospitality and retail will now also be required to wear face coverings (from 24 September).

- People who are already exempt from the existing face covering obligations, such as because of an underlying health condition, will continue to be exempt from these new obligations.

- Guidance stating that face coverings and visors should be worn in close contact services will now become law (from 24 September).

- Staff working on public transport and taxi drivers will continue to be advised to wear face coverings.

Working from home

To help contain the virus, office workers who can work effectively from home should do so over the winter. Where an employer, in consultation with their employee, judges an employee can carry out their normal duties from home they should do so. Public sector employees working in essential services, including education settings, should continue to go into work where necessary. Anyone else who cannot work from home should go to their place of work. The risk of transmission can be substantially reduced if COVID-19 secure guidelines are followed closely. Extra consideration should be given to those people at higher risk.

Businesses

- Businesses selling food or drink (including cafes, bars, pubs and restaurants), social clubs, casinos, bowling alleys, amusement arcades (and other indoor leisure centres or facilities), funfairs, theme parks, adventure parks and activities, and bingo halls, must be closed between 10pm and 5am. This will include takeaways but delivery services can continue after 10pm (from 24 September).

- In licensed premises, food and drink must be ordered from, and served at, a table.

- Customers must eat and drink at a table in any premises selling food and drink to consume on site (from 24 September).

- Businesses will need to display the official NHS QR code posters so that customers can ‘check-in’ at different premises using this option as an alternative to providing their contact details once the app is rolled out nationally (from 24 September).

- Businesses and organisations will face stricter rules to make their premises COVID Secure (from 28 September):

- A wider range of leisure and entertainment venues, services provided in community centres, and close contact services will be subject to the COVID-19 Secure requirements in law and fines of up to £10,000 for repeated breaches.

- Employers must not knowingly require or encourage someone who is being required to self-isolate to come to work.

- Businesses must remind people to wear face coverings where mandated.

Meeting people safely

- Support groups must be limited to a maximum of 15 people (from 24 September).

- Indoor organised sport for over 18s will no longer be exempt from the rule of six. There is an exemption for indoor organised team sports for disabled people (from 24 September).

- There will be a new exemption in those areas of local intervention where household mixing is not allowed to permit friends and family to provide informal childcare for children under 14 (from 24 September).

- Weddings and civil partnership ceremonies and receptions will be restricted to a maximum of 15 people (down from 30). Other significant standalone life events will be subject to the ‘rule of six’ limits, except funerals (from 28 September).

Government has announced an initial £60 million to support additional enforcement activity by local authorities and the police, in addition to funding that has already been awarded.

The spread of the virus is also affecting our ability to reopen business conferences, exhibition halls and large sporting events, so we will not be able to do this from 1 October.

The government’s expectation is the measures described above will need to remain in place until March.

Coronavirus Job Retention Scheme (Furlough)

How to make a claim:

Last week, government announced further updates to its Coronavirus Job Retention Scheme; that the furlough scheme would be extended to the end of June.

Many businesses have furloughed staff, and the portal is now open for these businesses to be able to make a claim for the grant.

You can now claim online for a grant for 80% of your furloughed employees’ salaries, up to a maximum of £2,500 per employee, per month, through the Coronavirus Job Retention Scheme.

Staff must have been on the company’s payroll as of 19th March 2020 and would have been at risk of redundancy if not furloughed; they must consent to furlough; and the period of furlough must be for a minimum of 3-weeks (presently, to 30th June 2020).

Apply by 22 April to receive money before the end of the month.

Full information was issued yesterday by HMRC which can be read here.

![]()

It’s good practice for employers to:

- Keep everyone updated on actions being taken to reduce risks of exposure in the workplace.

- Ensure employees who are in a vulnerable group are strongly advised to follow social distancing guidance.

- Make sure everyone’s contact numbers and emergency contact details are up to date.

- Make sure managers know how to spot symptoms of coronavirus (COVID-19) and are clear on any relevant processes, for example sickness reporting and sick pay, and procedures in case someone in the workplace is potentially infected and needs to take the appropriate action.

- Make sure there are places to wash hands for 20 seconds with soap and water, and encourage everyone to do so regularly

provide hand sanitiser and tissues for staff, and encourage them to use them.

What do Businesses need to know?

- Businesses and workplaces should encourage their employees to work at home, wherever possible.

- If someone becomes unwell in the workplace with a new, continuous cough or a high temperature, they should be sent home and advised to follow the advice to stay at home.

- Employees should be reminded to wash their hands for 20 seconds more frequently and catch coughs and sneezes in tissues

frequently clean and disinfect objects and surfaces that are touched regularly, using your standard cleaning products. - Employees will need your support to adhere to the recommendation to stay at home to reduce the spread of coronavirus (COVID-19) to others.

- Those who follow advice to stay at home will be eligible for statutory sick pay (SSP) from the first day of their absence from work

employers should use their discretion concerning the need for medical evidence for certification for employees who are unwell. This will allow GPs to focus on their patients. - Employees from defined vulnerable groups should be strongly advised and supported to stay at home and work from there if possible.

For further guidance on any of the above, please visit COVID-19: Guidance for Employers & Businesses

![]()

The Chancellor has set out a package of temporary, timely and targeted measures to support public services, people and businesses through this period of disruption caused by COVID-19.

This includes a package of measures to support businesses including:

- a statutory sick pay relief package for SMEs

- a 12-month business rates holiday for all retail, hospitality and leisure businesses in England

- small business grant funding of £10,000 for all business in receipt of small business rate relief or rural rate relief

- grant funding of £25,000 for retail, hospitality and leisure businesses with property with a rateable value between £15,000 and £51,000

- the Coronavirus Business Interruption Loan Scheme offering loans of up to £5 million for SMEs through the British Business Bank

- a new lending facility from the Bank of England to help support liquidity among larger firms, helping them bridge coronavirus disruption to their cash flows through loans

- the HMRC Time To Pay Scheme

For further guidance on any of the above please visit COVID-19: Support for Businesses

The Government have set up a helpline for businesses who may have any questions:

Business Support Helpline (England)

Telephone: 0300 456 3565

Monday to Friday, 9am to 6pm

The Business Support Helpline for England is also on:

The Black Country Chamber of Commerce has put together a package of support for local businesses, including a business helpline and online business clinics. Black Country Chamber of Commerce – Business Support Package

Sandwell Business Support Grants

West Bromwich Town BID is in daily contact with Sandwell Council, other BIDs and Governing Bodies to ensure that we provide the information and support your business needs on a regular basis. We have already been speaking with many of our Levy Payers via WhatsApp, Email and social media channels for news of upcoming information and support.

In response to Covid-19, the Government has announced grant schemes to support small businesses and businesses in the retail, hospitality and leisure sectors which are currently liable for Business Rates.

There are two schemes:

Scheme 1: Small Business Rate Support Grant

Eligible businesses in receipt of Small Business Rates Relief, with a rateable value of £15,000 or less will receive a £10,000 grant.

Scheme 2: Retail, Hospitality and Leisure Business Grants

Eligible businesses in the retail, hospitality or leisure industry will receive:

A £10,000 grant where the business has a rateable value of £15,000 or less, who are not eligible for Small Business Rate Relief; or

A £25,000 grant where the business has a rateable value between £15,001 and £50,999.

Only one grant can be awarded per property and to qualify you must be the ratepayer and must have been occupying the premises on 11 March 2020.

What do SMBC need from you:

You will need to provide further information, to do this please go online at:

https://my.sandwell.gov.uk/service/Business_Rate_Support_Grant

and complete the form making sure you answer all the questions so that SMBC can determine if you are eligible. If you are eligible, the grant will be paid into your bank account via BACS.

- If you have a Mysandwell account the link should take you straight to the form.

- If you don’t, you will have to set up a Mysandwell account (Name, email address & password)….. then you will get an email asking you to confirm your registration of the set-up of the mysandwell account (It’s clicking on a link in the email)….. Once you have done that you will be taken to the grant application form.

- Sounds complex but the process to set up a new mysandwell account takes under 5 mins

Please be advised that you will require your Business Rates account number (8 digits beginning with a ‘5’), 0on the application form.

We appreciate that these are difficult times and SMBC will deal with all applications as quickly as possible.

We are expecting a high number of requests, so we would ask for your patience. If SMBC need any further information they will contact you directly.

Exclusions:

Please note that certain exclusions apply:

- The grant cannot be paid if the property is occupied for personal use e.g. private stables and loose boxes, moorings, or used as a car park and parking spaces.

- The grant cannot be paid if the business was in liquidation or insolvent on 11 March 2020.

- The grant cannot be paid if the property has a rateable value of £51,000 or over.

- Any changes to the rateable value of the property after 11th March 2020, including changes backdated to this date will be ignored for the purposes of eligibility.

- Only one grant may be awarded per business property

For further information, please see the links below:

http://www.sandwell.gov.uk/info/200308/business_rates/4463/the_budget_-_march_202

Support for Businesses during COVID-19

Expanded Retail Discount Guidance

For Businesses over £51,000 rateable value operating in Retail, Leisure or Hospitality, Sandwell MBC will automatically apply the Expanded Retail Discount Relief (Business Rates Relief) for 12 months from 1st April 2020.

Sandwell Council have also launched a website dedicated to Coronavirus and has some useful information that may answer any questions you may have Sandwell MBC – Coronavirus